Price Series Generation

In order to demonstrate a rational behavior of the trading system, it was tested on various generations of artificial data. The prices were generated with the FDGenerator tool programmed during the thesis.

The price series are random walks with autoregressive trend processes trending on short scale and with a high level of noise. The iid random deviates used in the price generation model are drawn either from a Gaussian normal distribution with zero expectation and unit variance or from a shifted gamma distribution with shape parameter 5. The latter is preferred since its asymmetry seems to approximate realistically the empirical price returns of real world series, where the natural asset return distributions are mostly excessively peaked and heavy tailed. The sign of the gamma distribution can be adjusted in order to produce negatively or positively skewed random numbers and hence price series with the corresponding return distribution. The price generation model used originates from the formula of an autoregressive process of first order.

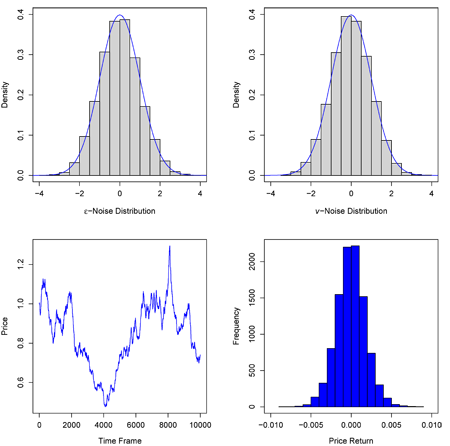

The following figure shows the normal distributed white noise used in the price generation model (top), the price series and price return distribution respectively (bottom).

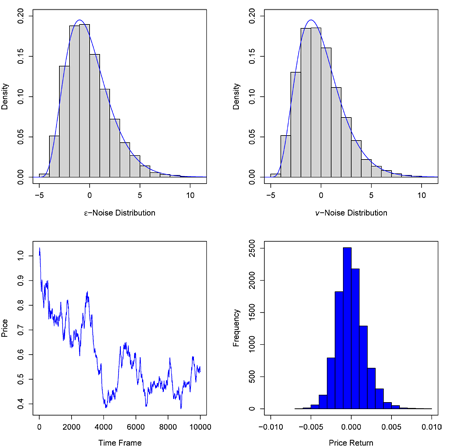

The next figure shows a price series that was generated with shifted gamma distributed noise.

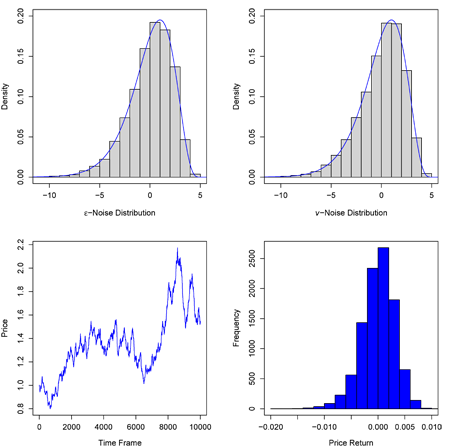

If the sign of the shifted gamma distributed noise is adjusted, a negatively skewed return distribution is obtained.

More details about the artificial price generation can be found in the Master Thesis and its references and in the source files on the SVN repository.